American Families With Single Heads of Household Quizlet

American Families Face a Growing Rent Burden

High housing costs threaten financial security and put homeownership out of attain for many

Dean Mitchell/Getty Images

Overview

Nearly 43 million U.S. households rented their homes in 2016, including virtually ix million households that were formed over the preceding decade, according to the Harvard Articulation Center for Housing Studies. Demand for rental properties has increased across age and socio-economic groups since 2008. Recent research indicates that although some of those increases can exist explained by population shifts, a significant portion is the result of declines in homeownership since the Great Recession.

In the aftermath of the 2007-09 downturn, households that rent have been slower to transition to homeownership than they were earlier the recession and housing crisis. Many families struggle to salvage plenty for a down payment or lack a sufficiently strong credit profile to meet the stringent underwriting standards that were put in place in the wake of the crunch. But some renters—even with downwardly payment assistance programs— simply cannot afford the monthly payments for homes that in many areas are commanding prices almost those of the 2007 market peak.

Merely as more households rely on renting for their long-term housing needs, they are finding the cost of renting increasingly onerous. The steadily rising demand for rental backdrop over the by decade has reduced vacancy rates to near historic lows, fueling a rapid increase in rental market prices that has outpaced household incomes for many families. This imbalance is contributing to high rates of "rent burden," which for the purposes of this assay is divers as spending 30 per centum or more of pretax income on rent. Rent-burdened households have higher eviction rates, increased fiscal fragility, and wider utilise of social safety net programs, compared with other renters and homeowners. And every bit housing costs swallow a growing share of household income, families must cut back in other areas.

The increasing share of income that goes toward rent may have broad implications for the long-term stability of renter households and for the economy every bit a whole. To better understand this growing threat and its potential consequences, The Pew Charitable Trusts undertook an in-depth study of the state's rent-burdened households. Using the Panel Study of Income Dynamics (PSID), a data set of U.Due south. household finances developed past the University of Michigan, Pew examined how increasing rent affected the ability of American households to use financial services, accrue savings, and transition to homeownership betwixt 2001 and 2015. Key findings include:

- In 2015, 38 percent of all "renter households" were hire encumbered, an increase of near xix percent from 2001.

- The share of renter households that were severely hire burdened—spending 50 per centum or more of monthly income on hire—increased by 42 percent between 2001 and 2015, to 17 percent. Increasing rent burdens were driven in part by twelvemonth-over-yr growth in gross rent—contract price plus utilities—that far exceeded changes in pretax income, which means that subsequently paying rent, many Americans take less money available for other needs than they did xx years ago.

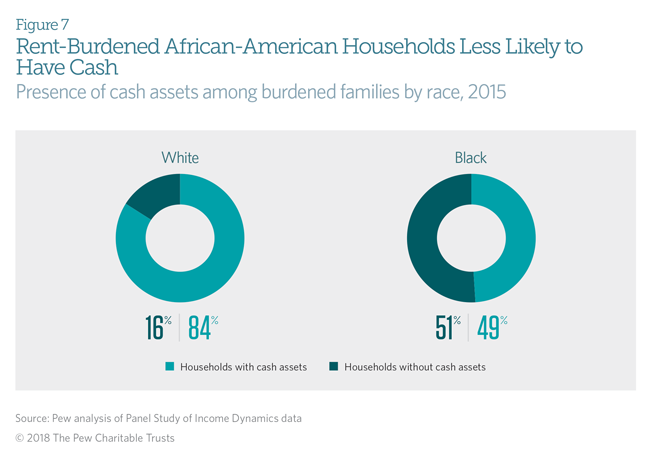

- In 2015, 46 pct of African-American-led renter households were rent burdened, compared with 34 pct of white households. Betwixt 2001 and 2015, the gap between the share of white and African- American households experiencing astringent rent burden grew by 66 percent.

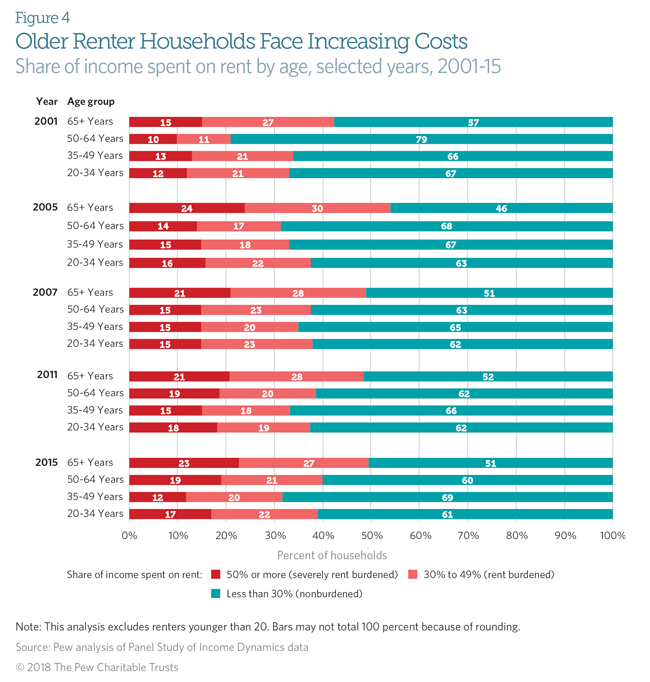

- Senior-headed renter households are more than likely than those headed past people in other age groups to exist rent encumbered. In 2015, about fifty percent of renter families headed past someone 65 or older were rent burdened, and more than a fifth were severely rent burdened.

- Rent-burdened families are also financially insecure in many other ways:

- Nigh two-thirds (64 percent) had less than $400 cash in the banking company; most (84 per centum) of such households are African-American-headed.

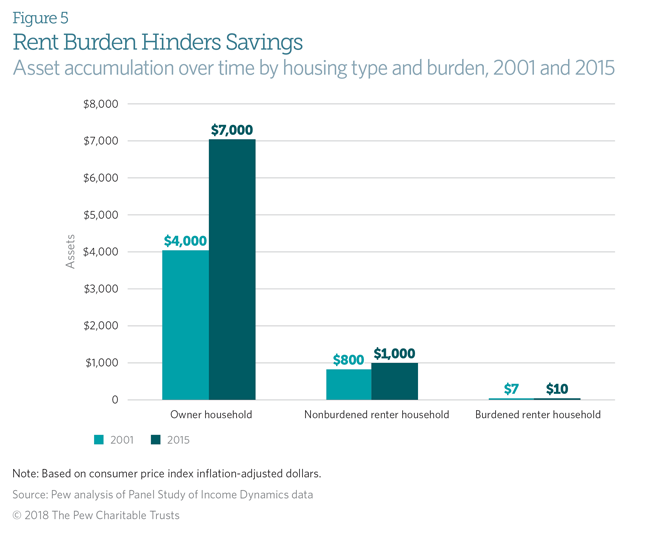

- Half had less than $ten in savings across various liquid accounts, while half of homeowners had more than $7,000.

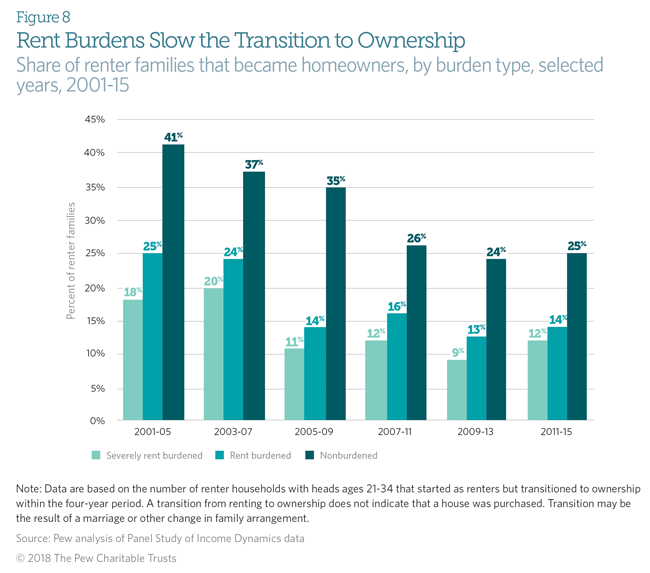

- Fewer rent-burdened households transitioned from renting to owning in 2015 than in 2001. Households that were hire burdened for at least a yr were less probable to buy a domicile than those that never experienced a rent burden.

The growing number of rent-burdened households suggests that a rising share of Americans may exist experiencing serious financial fragility. Policymakers should exist aware of the increase in rent burdens because if the trend continues, information technology could limit household consumption and reduce the economic mobility and financial resiliency of American families.

In the backwash of the 2007-09 downturn, households that rent take been slower to transition to homeownership than they were before the recession and housing crisis. Many families struggle to relieve enough for a down payment or lack a sufficiently strong credit profile to meet the stringent underwriting standards that were put in place in the wake of the crunch. Merely some renters—fifty-fifty with downward payment assistance programs— simply cannot beget the monthly payments for homes that in many areas are commanding prices near those of the 2007 market place peak.

Renting is on the ascent

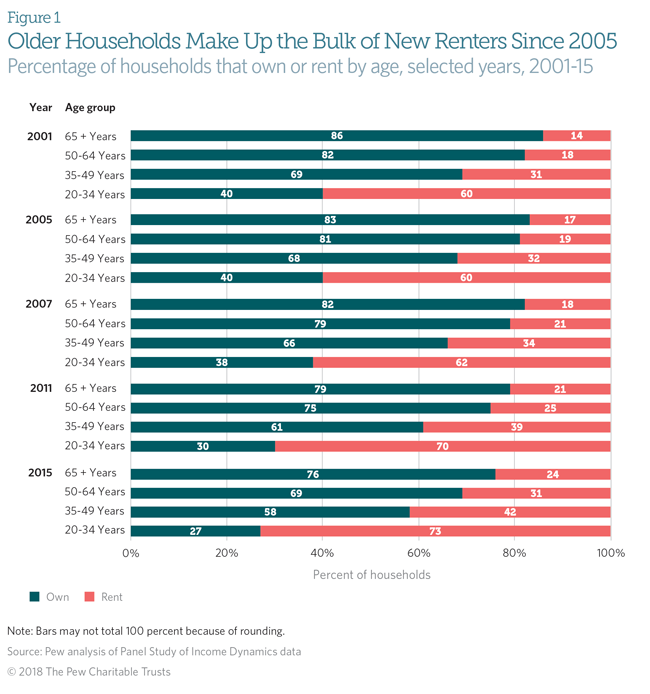

From 2001 to 2015, the demand for rental housing grew dramatically, driving prices to historic highs. In 2015, nearly 43 1000000 American households lived in rental housing, an increase of ix.three million since 2004 and the largest rising since 1970, when infant boomers (born between 1946 and 1964) were coming of historic period.1 The share of households that rent has increased by at to the lowest degree 10 percentage points since 2001 for all age groups. However, unlike the early 1970s when young families drove the increment in renting, the 2015 spike is largely propelled past those 55 and older, largely baby boomers, who are responsible for a four.3 one thousand thousand jump in the number of renters since 2005.2 (See Effigy 1.)

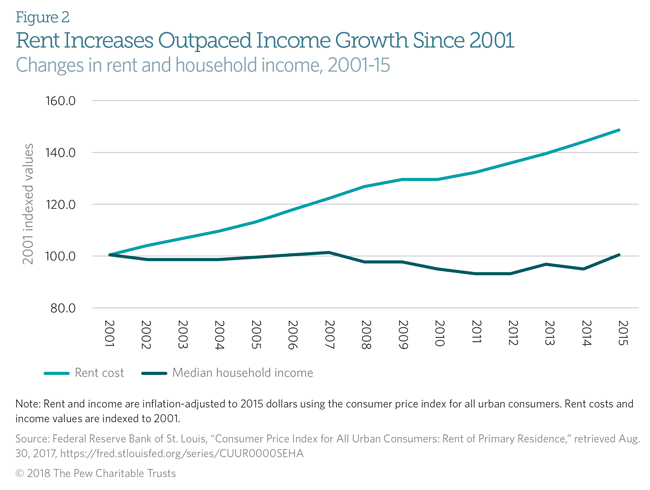

As their numbers grow, American renter households are as well spending more than on housing. Between 2001 and 2015, the median hire rose from $512 a calendar month to $678, a 32 percent increase.3 These figures exclude the price of utilities, though, and therefore practise non fully measure the increment in expenditures. And year-over-year growth in gross rent far exceeds changes in pretax income during the same period. Since 2001, gross hire has increased 3 percent a yr, on average, while income has declined by an average of 0.one percentage annually, falling from $56,531 in 2001 to $56,516 in 2015. (Encounter Effigy 2.) This widening gap between hire and income means that after paying rent, many Americans accept less coin available for other needs than they did 20 years ago.4

Short Supply and Heavy Demand

The home purchase and rental markets are closely linked, every bit changes in 1 straight bear on the other. If the supply of homes for sale can run across or exceed the demand by potential buyers, experts would wait rental supply to increase and rents to refuse. Conversely, if the demand for ownership is non met because of limited supply, unaffordable prices, or tight credit, experts would expect rental stocks to dry upwards and rents to increase and consume a larger share of household income. The rent data featured in this report reflect a combination of factors: For the years studied, declining homeownership and demographic shifts were the master drivers of rental demand.*

The nation'due south homeownership rate peaked in 2004, when 69 percent of Americans owned their homes.† The recession suppressed abode purchases and led to millions of families losing homes to foreclosure, which together helped cut the buying rate to 63 percent by 2015.‡ Over the years earlier the crisis, 2001-05, 20 percent of renter households reported becoming homeowners; afterwards the recession, 2009-15, that figure was only xiii per centum, a decline of forty percent. With far fewer renter households becoming owners since the recession, need for rental homes has grown faster than the supply.

Some experts have suggested that changing attitudes are fueling the decline in ownership, with younger adults preferring to rent.§ However, a 2016 Pew Enquiry Middle survey establish that 72 percent of renters said they desire to purchase a home at some betoken, and most cited fiscal reasons when asked why they rent.|| Another recent public opinion poll asked renters ages xviii-34 why they were not buying homes, and 57 percent said they could not obtain a mortgage.# On the other hand, a recent survey of Americans over 55 found that 71 percent of those who plan to motility over again said they intended to rent rather than buy.** Most renters over 55 cited cost as a driver of their decision and said it makes the most sense for people their age to hire.††

During the recession and housing crisis, viii million to ten million properties were foreclosed. The widespread loss of homes has had a lasting touch on on the housing market place. According to the National Association of Realtors, less than a tertiary of these households volition return to homeownership.‡‡ Some of these families have seen their economical situations improve but, in part because underwriting standards tightened significantly after the crisis, they still lack

the credit profiles necessary to qualify for mortgages. In fact, some experts estimate that 6.three million additional mortgages would have been issued if not for tighter credit standards between 2009 and 2015.§§ Further, families that went through a foreclosure, short sale, bankruptcy, or deed in lieu of foreclosure face additional hurdles, typically including being ineligible for Federal Housing Administration-insured mortgages for 3 years and the financial challenges arising from rents that are increasing faster than aggrandizement. Many of those would-be owners are renting, farther reducing rental supply and raising rents.

With fewer people transitioning from renting to owning, the stock of available rental properties is declining. As of tardily 2016, the national rental vacancy rate was about 7 percent,|| || which is amongst the everyman levels since the 1980s, when the charge per unit reached a celebrated low of v percentage. At the same fourth dimension, owners are staying in their homes longer: Between 1985 and 2008, the median tenure of an owner in a home (that is, time residing in that location) earlier selling was six years, but since 2009 that has increased to 9 years.## The recession left millions of families in housing that was worth less than the amount still owed on the mortgage, effectively forcing them to stay in their homes longer. As of 2016, an estimated 3.ii million to iv million U.S. homes were valued beneath the mortgage balance.***

The housing crunch also disrupted the single-family rental property market past altering the traditional owner-to-landlord cycle. Private investors who convert their starter homes into a rental property after upgrading to a different dwelling take traditionally accounted for a large share of the unmarried-family rental market. The proportion of rental properties endemic by individual investors was almost 87 percent in 2015, which though still high is downward from the peak of 92 percent in 1991.†††

In summary, the increased demand for rental backdrop and their limited supply, along with the lingering effects of foreclosures, demographic changes, and a decline in the charge per unit of renters transitioning to owning, have led to college rents.‡‡‡ In turn, rising rental prices have

outpaced wage increases and inflation across America, leading to a growing number of rent- burdened households.

* This study focuses on the factors that Pew believes have the most impact on the housing market place. Rising rental demand may also be the event of credit scoring problems, lack of savings, quality of rental backdrop, location of bachelor rental properties, inability to save, and eviction laws, among other causes.

† U.S. Census Bureau, "Quarterly Residential Vacancies and Homeownership, First Quarter 2017" (April 27, 2017), https://www.census.gov/housing/hvs/files/qtr117/Q117press.pdf. The Demography Bureau announced the following residential vacancies and homeownership statistics for first quarter 2017: https://world wide web.census.gov/housing/hvs/files/currenthvspress.pdf.

‡ Ibid.

§ Chris Matthews, "Immature People Tin can Afford Homes, They Just Don't Want to Exist Homeowners," Forbes, Aug. 18, 2015, http://fortune.com/2015/08/18/young-people-tin-afford-homes-they-simply-dont-desire-to-be-homeowners.

|| Richard Fry and Anna Brown, "In a Recovering Market, Homeownership Rates Are Down Sharply for Blacks, Immature Adults," Pew Research Center (2016), http://www.pewsocialtrends.org/2016/12/fifteen/in-a-recovering-market-homeownership-rates-are-downwards-sharply-for-blacks-immature-adults.

# Fannie Mae, "Fannie Mae National Housing Survey: What Parents Tell Us About Their Adult Children Living at Dwelling house" (2014), http://www.fanniemae.com/resources/file/enquiry/housingsurvey/pdf/ nhsjuly2014presentation.pdf.

** Freddie Mac, "Americans 55+ Assess Current and Future Housing Options" (2016), http://world wide web.freddiemac.com/ research/consumer-research/20160628_five_million_boomers_expect_to_rent_next_home_by_2020.html.

†† Ibid.

‡‡ Laura Kusisto, "After Foreclosure, Fewer Buy Homes," The Wall Street Periodical, Apr 21, 2015, http://online.wsj.com/ public/resources/documents/print/WSJ_-A002-20150421.pdf.

§§ Laurie Goodman, Jun Zhu, and Bing Bai, "Overly Tight Credit Killed 1.i Million Mortgages in 2015," Urban Constitute (2016), https://www.urban.org/urban-wire/overly-tight-credit-killed-xi-million-mortgages-2015.

|| || U.S. Demography Bureau, "Quarterly Residential Vacancies and Homeownership, Third Quarter 2016."

## Keeping Current Matters, "How Long Do Most Families Stay in Their Dwelling?" accessed October. 12, 2017 https://world wide web.keepingcurrentmatters.com/2017/02/28/how-long-do-near-families-stay-in-their-home.

*** Gail MarksJarvis, "Chicago Among Cities With Largest Share of Underwater Homeowners, Studies Show," Chicago Tribune, June nine, 2016, http://world wide web.chicagotribune.com/business/ct-underwater-homeowners-chicago-0610-biz- 20160608-story.html; Diana Olick, "How Are Millions Still Underwater every bit Dwelling Prices Rising?" CNBC, April 4, 2016, https://www.cnbc.com/2016/04/04/how-are-millions-still-underwater-as-home-prices-rising.html. ††† U.S. Census Bureau, "Who Owns the Nation's Rental Properties? Statistical Cursory, March 1996, https://www.census.gov/prod/ane/statbrief/sb96_01.pdf; Ronda Kaysen, "Smaller Housing Markets Lure Individual Investors," The New York Times, July 28, 2017, https://www.nytimes.com/2017/07/28/realestate/smaller-housing-markets-lure-individual-investors.html?_r=0.

‡‡‡ Pedro Gete and Michael Reher, "Systemic Banks, Mortgage Supply, and Housing Rents," 6 (newspaper presented at the annual coming together of the American Economical Association, Chicago, Jan. 4–8, 2017), https://world wide web.aeaweb.org/conference/2017/preliminary/1668?page=xi&per-page=50.

Measuring hire burden

Today, more families are putting a larger share of their income toward hire. In the Housing and Urban Development Act of 1969, Congress defined housing affordability every bit monthly costs of no more than 25 per centum of household income. During the 1981 upkeep crisis, however, Congress increased the amount to xxx percent or less of household income to reduce the amount the federal government spent on housing subsidies.

Just that definition has its critics,5 because information technology may non capture the truthful cost of renting, for several reasons. First, the federal figure is based on annual pretax, post-transfer income—full household income plus benefits from government programs such as Social Security—which is oft meaningfully larger than after-revenue enhancement, mail service-transfer income and then produces a lower approximate of cost burdens than the after-tax figure. Second, estimates that rely on gross hire fail to capture differences in housing quality, which affect renters' costs. In addition, variations across data sets and methods of collecting and calculating income, rent, and gross rent tin result in substantial variation in cost estimates.

Given this debate, Pew opted to use a conservative calculation for rent burdens. The findings in the subsequent sections of this paper are based on the concepts of gross hire and pretax, mail service-transfer income, including housing assistance. Renters who exercise not pay rent are considered to not be encumbered by rent, and those without income are assumed to be rent burdened. These choices, combined with the selected data sets, result in a highly conservative guess—probably the bare minimum percent of households that feel rent price burdens. Regardless of the methodological differences, however, most studies come to the same conclusion: The number of people who are financially constrained by the price of rent is increasing. (See the methodology for more information.)

A closer look at rent-burdened Americans

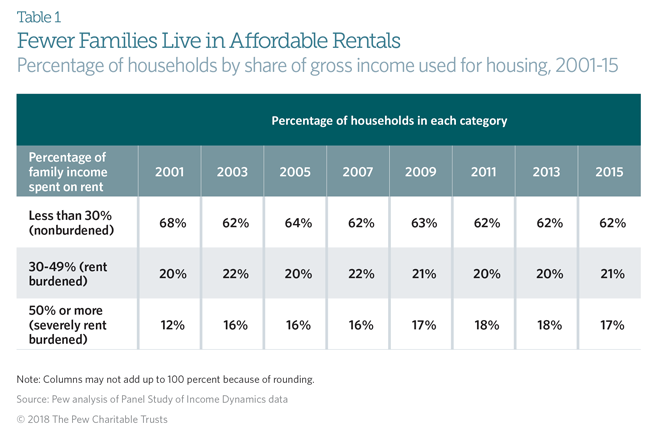

In 2015, at least 38 pct of renter households were rent burdened, compared with 32 percent in 2001, an increase of nineteen percentage over that period.6 (See Tabular array i.) Farther, the number of severely burdened families grew by 42 percent—to 17 percent of all renters—during the same catamenia. That xi million Americans have so little slack in their budgets is troubling, only farther study is needed to fully understand how hire burdens bear on long-term household financial security and economic mobility.7 Because of the PSID'southward sampling and methodology, this study'southward estimated per centum of renter households that are burdened should be viewed as the most conservative approximation bachelor, representing the minimum assessment of rental burdens and not the maximum.

Demographics

Race

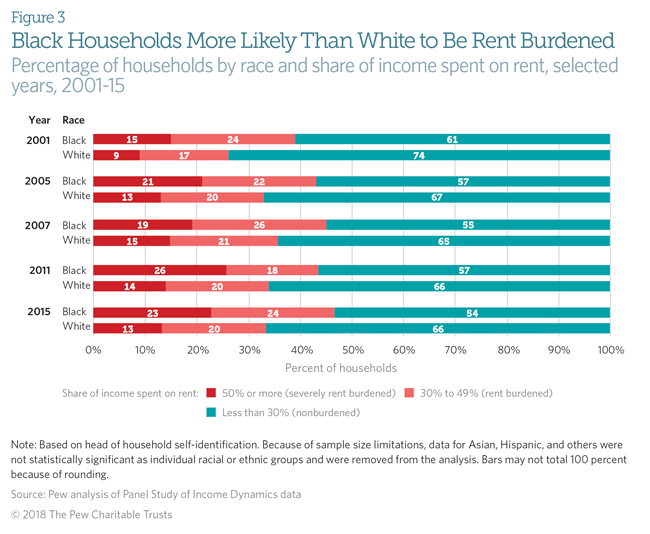

The percentages of African-American and white renter families that were rent burdened grew from 2001 to 2015, but although African-American renter households were consistently more than likely to be burdened, the gap between the 2 groups remained roughly stable. However, the difference between the shares of white and black renter households that were severely hire burdened widened by 66 percentage over that period. In 2001, xiii percentage points separated the shares of white and African-American renter households that were burdened: 26 and 39 percent, respectively; the gap between severely rent-encumbered white and black renters was 6 per centum points: about ix percentage versus xv percent, respectively. (See Figure 3.) By 2015, the share of African-American-led renter households that were encumbered had risen to 46 percent and severely burdened, 23 percent; amidst white renter families, the figures were 33 and 13 percentage, respectively.

Income

For families in the bottom 20 percent of household income, for whom rent burdens are nearly pronounced, the racial disparities are fifty-fifty more substantial. The 2015 median income for all bottom-quintile households was $xi,701, but medians differed starkly across racial groups: $12,700 for white families and $xi,000 for African- Americans, a difference of $ane,700, or more than 13 percent. However, black families in this income group paid slightly higher median rent in 2015 than did their white counterparts: $half-dozen,024 versus $5,940 annually.

Age

Although Americans of all ages rent, older households tend to be more than rent burdened than younger families. In 2001, 43 percent of households headed past someone 65 or older were rent burdened, compared with 33 percentage for 20- to 34-year-olds, 34 percentage for 35- to 49-year-olds, and 21 percent for fifty- to 64-yr-olds. (See Figure 4.) Over time, the proportion of hire-burdened households rose for all age groups, only older households remained the well-nigh affected. By 2015 the proportion of households that were hire burdened increased to 39 percentage among twenty- to 34-year-olds, 31 pct for 35- to 49-twelvemonth-olds, twoscore percent for 50- to 64-year-olds, and most l percentage of those 65 and older. Farther, more a fifth (23 percentage) of households 65 and older were severely hire burdened in 2015.

Financial health of cost-encumbered renters

Rent-burdened families are financially insecure in many other aspects of their lives, likewise. They oftentimes take trouble coming together basic consumption needs, frequently rely on public aid, and typically have petty connection to the banking arrangement and express savings.

In general, renter households have less money across their financial accounts than practise nonburdended families and those that ain their homes.8 In 2001, half of hire-burdened households had less than $10 in savings, while the median non-rent-burdened family had $800 in inflation-adjusted dollars, and half of homeowners had more than $4,000.9 By 2015, the savings of nonburdened renter families had increased to slightly more than $1,000 at the median10 and that of possessor households had nearly doubled, to $seven,000. But hire-encumbered households even so had less than $10. (Meet Effigy 5.)

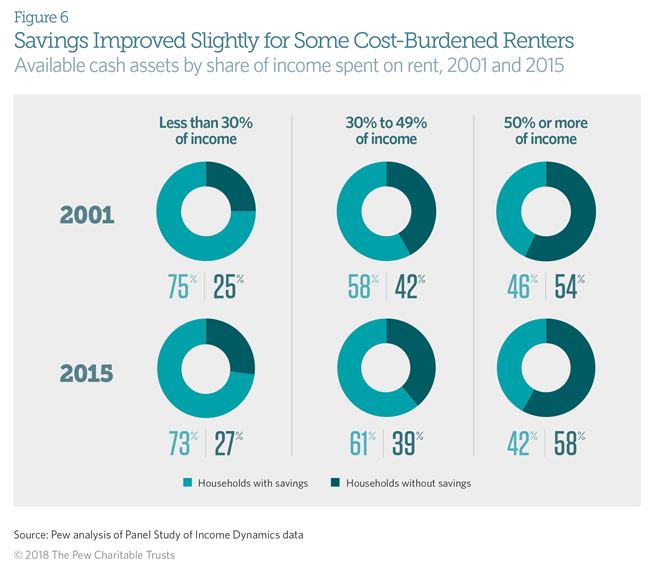

Similarly, rent-burdened families are generally less likely than nonburdened renter households to have coin in an account at a financial institution. In 2001, 33 percent of all U.Southward. renter households had no money in an account; by 2015, it was 36 percent. In 2001, 42 percentage of rent-encumbered families were without savings; by 2015, it had declined to 39 percent. For the severely rent encumbered, however, the story went from bad to worse: The percentage without cash assets increased from 54 pct in 2001 to 58 percent in 2015. (See Figure 6.)

Rent-burdened families conspicuously have lower savings than do the nonburdened. Overall, 64 pct of hire-burdened families, including the severely burdened, had less than $400 in savings in 2015. When considered by race, notwithstanding, stark differences emerge: A vast bulk (84 percent) of African-American hire-burdened households had less than $400, compared with 54 percent of like white households. And as of 2015, more than than half of black hire-burdened households had no savings versus just xvi percent of burdened white households. (Come across Figure seven.) Equally previous Pew inquiry has shown, households that lack liquid savings accept more difficulty coping with unexpected expenses and income volatility, making them more vulnerable to long-term fabric hardship.

The percentage of severely rent-burdened African-American households without savings improved slightly from 2001 to 2015, dropping from 81 to 79 percent. Amongst rent-burdened black families, households with heads under age 34 had the lowest savings rate in 2015: Only 14 percent had coin in a financial institution. The simply historic period grouping that had a higher savings rate in 2015 than in 2001 was families 65 and older. These low savings rates suggest that hire-burdened families have marginal attachment to the traditional cyberbanking system and that many of these households may rely on nonbank services such as check cashers and high-cost, small-dollar lenders to run across their financial needs.11

Overall, 64 percentage of rent-burdened families, including the severely burdened, had less than $400 in savings. When considered by race, however, stark differences sally: A vast bulk (84 per centum) of African-American rent-burdened households had less than $400, compared with 54 percent of similar white households. Equally previous Pew research has shown, households that lack liquid savings take more difficulty coping with unexpected expenses and income volatility, making them more vulnerable to long-term material hardship.

Financially constrained, rent-burdened families tin can have difficulties paying for core needs such as nutrient, transportation, wellness care, and clothing. For instance, in 2015, a severely rent-encumbered two-earner, ane-child household in which both earners made the federal minimum wage would accept had about $250 a week in pretax dollars after rent to comprehend child care, transportation, food, health insurance, and other necessities.12 A unmarried mother who was severely rent burdened would have had about $124 pretax, or near $17 a twenty-four hours, after the rent was paid.

Long-term financial impact of rent burdens

High rents are a problem for a growing proportion of American households. However, information are limited on how increasing rents affect families' finances in the long run. The impacts on household balance sheets and time to come wealth may depend on how long a family unit rents or is burdened by rent.

To assess the effects of renting elapsing and the long-term financial implications of being rent burdened, this department of the study narrows in scope to wait but at families that participated in the survey for the full 15 years. Amongst those that rented for at least one year betwixt 2001 and 2015, the average number of years spent renting was eight, with 50 percent of households renting between four and xiii years. At the margins, 20 percent of families rented for 14 years or more than, and 17 percentage of families rented for two years or less.

Fifty-six percent of all renters spent at least i year being rent burdened,thirteen and virtually 34 percent experienced rent burdens for iii or more years. The boilerplate elapsing of a rent burden was about three years.xiv Farther, existence hire encumbered in one year was correlated with beingness rent encumbered the next yr. Among renter households that spent ane yr with rent burdens, 74 pct endured two to 6 additional years struggling with rent.

Despite the transitory nature of beingness rent burdened, even a short spell may have an result on the potential for homeownership. To get a better idea of how being rent burdened is associated with homeownership, Pew looked at household housing status in one year then looked at the aforementioned households' housing condition iv years later. Nationally, the percentage of prime buying-historic period renter households—those headed past people ages 21-34— that transitioned from renting to owning declined from 26 percent in 2001 to xvi percent in 2015. Fifty-fifty given that overall decrease, compared with households that were never burdened, rent-encumbered households were less likely to become homeowners in the four years after a rent-burdened spell.

Among those prime number buying-age renter families, 25 percent of those that were rent burdened in 2001 became homeowners past 2005, compared with 41 pct that had affordable hire in 2001. (See Effigy viii.) Between 2003 and 2007, the figures were 24 and 37 percent, respectively. Betwixt the first of the housing credit crunch in 2007 and 2015, only fourteen percent of prime number-age, rent-encumbered households transitioned to homeownership each yr, on average. Over the same period, an average of 1 in 4 nonburdened families became homeowners annually.

This decline in the share of toll-burdened renters attaining homeownership suggests that although the economy is recovering, rent-burdened households accept a harder time accumulating savings and wealth today than they did earlier the crisis. Although this analysis is descriptive and cannot isolate causal relationships between these factors, the meaning decline in rent-encumbered households transitioning to buying may exist an early warning sign that those in the lower economic echelons will have a harder time becoming owners in the future.

Conclusion

An increasing number of American families are struggling to pay the rent, and that burden is affecting other parts of their balance sheets. In 2015, 7 million households spent more than half of their income on rent. Cost- encumbered renter households have fiddling to no financial slack in their budgets, which puts fiscal security out of achieve for many. Fifty-fifty at moderate levels, being rent burdened erects barriers to saving and wealth building.

Renter households nationwide had footling savings growth from 2001 to 2015 and now have a lower probability of transitioning to homeownership than they did 15 years ago. But past far the largest declines in buying attainment have been amidst those who pay 50 percentage or more of their household income for rent.

These findings on the increasing number of households affected by the cost of rent—as well as on the decline in homeownership—should raise concerns among policymakers at all levels of regime who focus on family financial well-being and economic opportunity.

Methodology

Throughout this study, rent burden has been measured every bit having hire equal to or greater than 30 percent of a household'due south gross income. This is different from the "greater than 30 percent of gross household income" metric used by the Harvard Joint Center for Housing Studies. Pew researchers conducted a sensitivity analysis using both measures and found no statistically meaning differences, and in most cases the variations between the measurements were less than those induced by rounding.

All information reported in this paper are from the PSID, collected by the University of Michigan. The information has been collected from the same families continually since 1968; the study switched from annual to biennial data collection in 1997. Although additional samples have been added periodically over the years, the information used in this analysis come only from the study's original families from every survey conducted from 2001 to 2015. Family income in the PSID includes the total earnings, transfers, investments, and other nonwage sources of coin as reported by all family members for the previous calendar yr. Some recoding and cleaning was performed on the income data. The few cases of negative and nil family income in a given survey year were recoded to $1.

The data include 122,440 family-years. When restricted to households that were in the ascertainment period for 10 or more years, the number of family unit-year observations decreases to 105,298. About 15,305 households are represented in the information for each yr.

All statistics relating to household savings are based on the imputed values of the following PSID survey question:

"IMP WTR CHECKING/SAVING (W27) 01 "

W27. Do [yous/you or anyone in your family] have whatever money in checking or savings accounts, coin market funds, certificates of deposit, government savings bonds, or Treasury bills—not including assets held in employer- based pensions or IRAs?

The values may not be monies designated for savings but are considered savings because they had not been consumed at the time of the survey.

Additionally, all questions related to whether a household rents or owns are based on the following PSID question:

A19. Do (you (or anyone else in your family living there) / they (or anyone else in the family unit living at that place)) own the (flat/mobile habitation/abode), pay rent, or what?

For the purpose of this analysis, respondents who answered "neither owns or rents" are considered to exist renter households. Sensitivity testing was conducted to decide if the coding decision had a textile outcome, and the results indicated information technology did not.

Endnotes

- Harvard Joint Center for Housing Studies, "The State of the Nation'south Housing, 2016"( 2016), http://www.jchs.harvard.edu/research/state_nations_housing; Freddie Mac, "Americans 55+ Assess Current and Future Housing Options" (2016), http://www.freddiemac.com/research/consumer-research/20160628_five_million_boomers_expect_to_rent_next_home_by_2020.html.

- Harvard Articulation Eye for Housing Studies, "The State of the Nation'southward Housing, 2016."

- This figure was calculated using only 2015 PSID information for those who paid at to the lowest degree $1 a twelvemonth in hire and was adjusted for inflation to 2017 dollars using the CPI deflator. Stricter definitions would meaningfully heighten the median and mean rents.

- According to the U.S. Census Bureau's American Community Survey, the median rental toll was $934 (real dollars) as of 2014, upwards $72 dollars (8 percentage) since 2005. Our published numbers are based on the analysis of PSID data.

- U.S. Department of Housing and Urban Development, "Rental Burdens: Rethinking Affordability Measures," The Edge, accessed Oct. 12, 2017, https://www.huduser.gov/portal/pdredge/pdr_edge_featd_article_092214.html.

- The PSID data used for this report follows the same families over time, which may issue in less variation in the number of renter households establish to be burdened and probably produces a very bourgeois judge of the number of hire-burdened households.

- U.South. Department of Housing and Urban Evolution, "Affordable Housing: Who Needs Affordable Housing?" accessed Oct. 12, 2017, https://portal.hud.gov/hudportal/HUD?src=/program_offices/comm_planning/affordablehousing.

- For convenience, this paper refers to these monies as savings, but in actuality they are funds held in financial institutions that can be used for whatever purpose. (PSID QUESTION: Do you [or anyone in your family unit living in that location] have any money in checking or savings accounts, coin market funds, certificates of eolith, government savings bonds, or Treasury bills?)

- In 2001, the hateful value of savings for not-rent-burdened homes was $7,300, and for households that endemic their homes it was

$34,900, both in constant dollars.

- Mean value of savings for nonrent cost-burdened homes was $15,300 in constant dollars in 2015.

- Federal Deposit Insurance Corp., "2015 FDIC National Survey of Unbanked and Underbanked Households" (2016), https://world wide web.fdic.gov/householdsurvey/2015/2015report.pdf.

- This figure is based on the boilerplate annual hours actually worked per worker (one,790 in 2015) using data from the Organisation for Economic Cooperation and Development. OECD, "Average Almanac Hours Actually Worked Per Worker," accessed Oct. 12, 2017, https://stats.oecd.org/Index.aspx?DataSetCode=ANHRS.

- This figure includes only respondents who were renters and were surveyed for at least 10 years.

- Moving in with a friend or relative and other undisclosed situations were included in terminations of the rental menstruum. This inclusive definition may effect in an underestimation of the length of rent burdens because being homeless is not necessarily gratuitous and the likely toll of long-term homelessness would create an economic situation like to or worse than being severely hire burdened. Some portion of those terminating their rental may accept done so through loss of housing.

MORE FROM PEW

Source: https://www.pewtrusts.org/en/research-and-analysis/reports/2018/04/american-families-face-a-growing-rent-burden

Post a Comment for "American Families With Single Heads of Household Quizlet"